Despite the decline of the global remittance market this year, Western Union (NYSE:WU) will be able to continue to create shareholder value for years to come. I believe that the downside of opening a long position in the company at this stage is limited since all the risks are already priced in, and the company has several catalysts which will help it to improve its bottom line in the foreseeable future. Since there’s already an indication that Western Union’s business is recovering, I decided to buy the company’s shares and plan to hold it for a considerable time.

Solid Company to Own For the Long Term

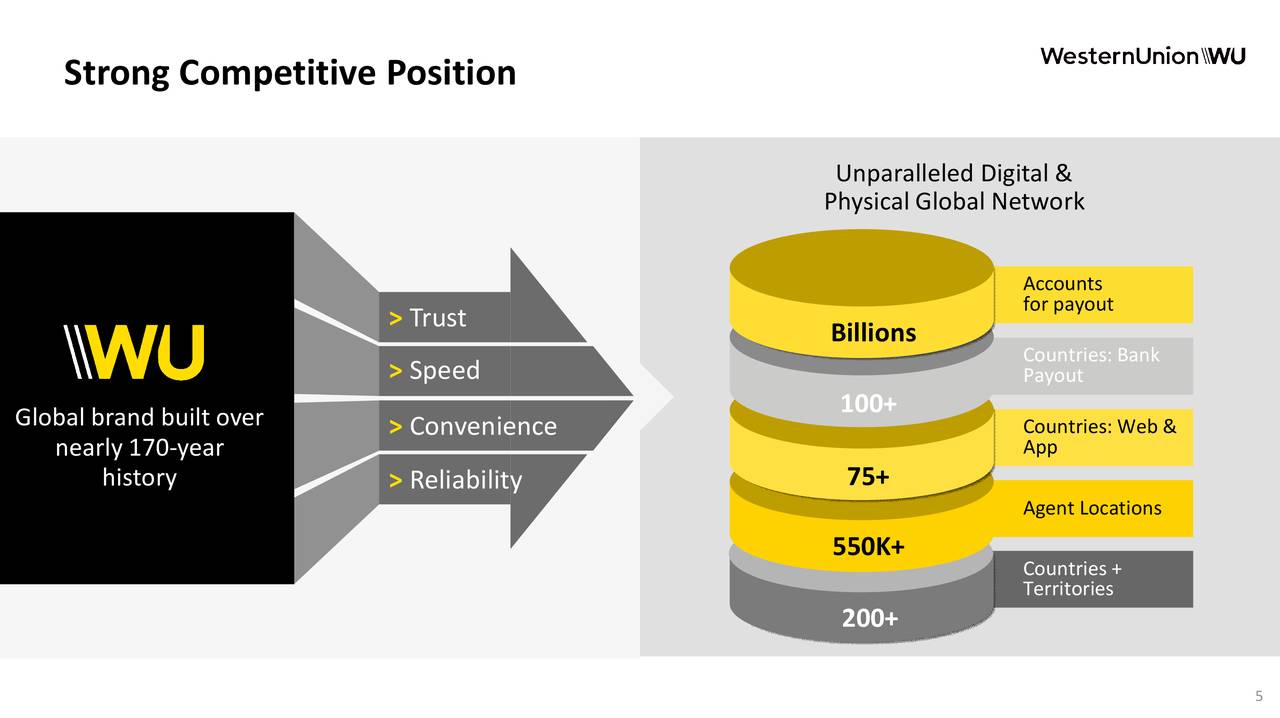

Western Union is one of the largest cross-border remittance companies in the world. For nearly 170 years, Western Union has been successfully transferring money between its clients around the globe, and its business continues to make profits to this day. The company has survived the Great Depression, two World Wars, the Cold War, numerous market crashes, and technological disruptions, and it’s still able to create value and reward its shareholders along the way. Currently, Western Union has one of the most sophisticated online and offline networks for transferring money around the world, and there’s every reason to believe that it will continue to be a dominant player in the payment industry.

Source: Western Union

The problem is that Western Union has a lot of physical locations across the globe, and as a result of lockdowns, its top-line suffered in Q2. From April to June, the company’s revenue declined by 17.2% Y/Y to $1.11 billion, but the company still made a profit, as its non-GAAP EPS was $0.41. In addition, just like MoneyGram (NASDAQ:MGI), Western Union experienced a rise of digital transfers, as its Q2 digital revenue was up 48% Y/Y to $219 million.

The good thing is that Western Union has $1.18 billion in cash and an ability to raise an additional $1.5 billion from its credit facility. While the company also has a net debt position of $2.14 billion, it has no major debt maturity until 2022, so its business will not need to raise more debt and increase its debt load anytime soon. In addition, Western Union is on track to save $50 million this year thanks to the execution of several cash preservation measures.

The major downside of Western Union at this stage is that the company will not be able to grow its top line due to the decline of the global remittance market this year, which was caused by the pandemic. The lack of immigrant workers around the globe along with the closing of walk-in locations during the initial stages of the pandemic will hurt the cross-border payment business in 2020. World Bank already estimates that remittances to low and middle-income countries will be down 19.7% Y/Y in 2020 to $445 billion. However, the market will start to recover in 2021 and will increase by 5.6% Y/Y next year to $470 billion.

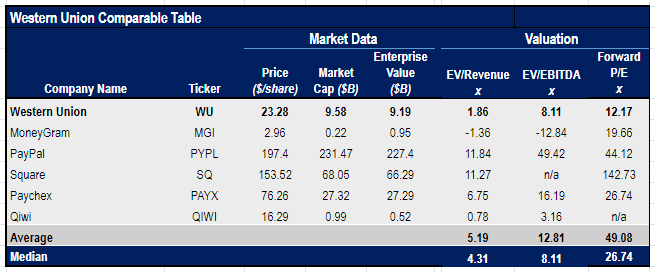

Considering this, there’s every reason to believe that Western Union is a solid long-term investment at this stage, and its downside is already priced in. First of all, Western Union will continue to be one of the most recognized cross-border remittance businesses across the globe, which certainly should be considered as a competitive advantage. In addition, 55% to 60% of the company’s costs are variable, which means that it can aggressively cut down its expenses and offset the possible losses in the foreseeable future. Also, the company trades at a lower EV/Revenue and Forward P/E ratios in comparison to its industry rivals, and its stock should be considered a bargain at the current price.

Source: Yahoo Finance. The table was created by the author.

The good news is that most walk-in locations of Western Union have reopened around the world, and its C2C transactions already showed a Y/Y growth during summer. In addition, the growth of the digital side of the business helped Western Union to minimize its downside, as digital active monthly users in Q2 increased by 45% Y/Y and 33% Q/Q, and its app became the most downloadable app among its peers in the app market. The growth of digital business along with the recovery of the walk-in revenues will help Western Union to improve its earnings in the second half of the year.

In addition, the greatest competitive advantage of Western Union is that the company is present in nearly every country in the world. Over the last century, Western Union has been constantly expanding and adapting to various regulatory environments in different markets. Every year, the company spends a single-digit percentage of its revenues on compliance, which helps its business to thrive. This is something that a lot of people overlook. The failed launch of Facebook’s (NASDAQ:FB) digital currency Libra clearly shows that the barrier to enter the cross-border remittance market is high, and for that reason, Western Union will continue to be a dominant player there with little competition.

Considering all of this, it’s safe to say that, despite the decline of its business in Q2, Western Union was able to make a profit, and the street continues to believe that the company will continue to make money even in the current environment. For that reason, I hold a long position in the company and have no plans to sell it in the near term.

Disclosure: I am/we are long WU, MGI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you need Digital Marketing or Digital Transformation help in your company? Know how we can help you or your company succeed in the Digital Era. Access our website, know more about our services, and get in touch! We are an amazing Digital Marketing Agency, with high technical skills to make you thrive! JSA Digital

Content Originally Published by Google.

source https://blog.jsa.digital/index.php/2020/10/02/western-union-bargain-at-this-price-nysewu/

No comments:

Post a Comment